Tax Deadline 2025 California Extended 2025

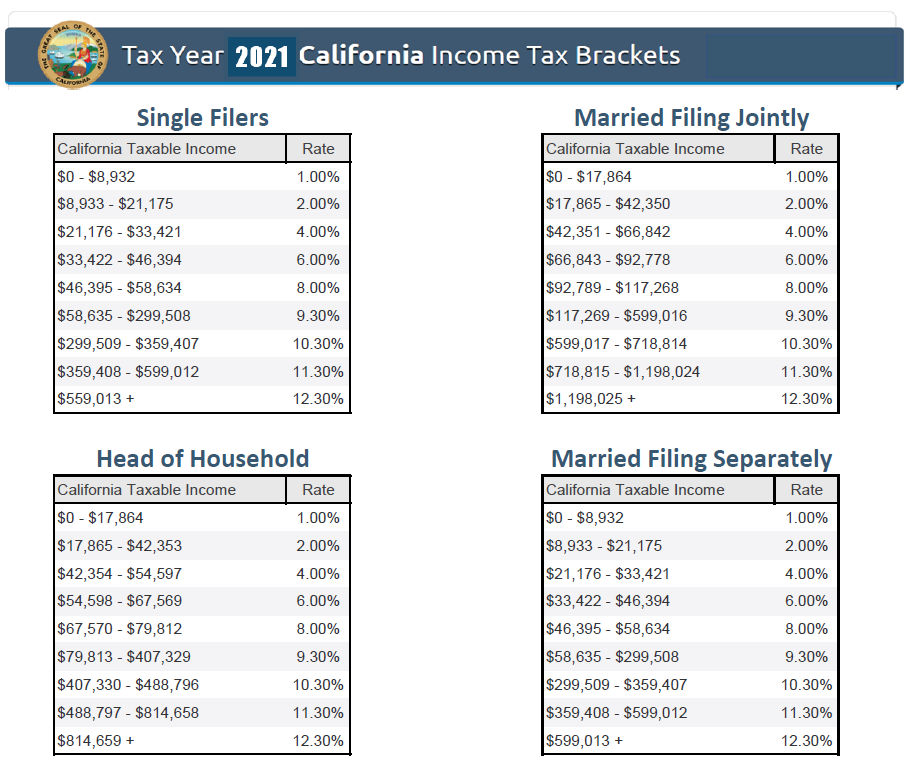

Tax Deadline 2025 California Extended 2025. The form gives individuals until october 15 to file their federal. Understand the specifics of california tax, including rates and deductions applicable for the 2025 tax year.

Individuals and businesses with their principal residence or place of business in san diego county will have until june 17, 2025, to file certain california individual and business tax. Understand the specifics of california tax, including rates and deductions applicable for the 2025 tax year.

Irs California Tax Deadline Extended 2025 Biddy Annadiana, The first relates to tips, which must be reported to your.

Irs California Tax Deadline Extended 2025 Katee Ethelda, The irs begins accepting tax year 2025 returns on jan.

Tax Deadline 2025 California State Kimmi Noella, Understand the specifics of california tax, including rates and deductions applicable for the 2025 tax year.

Tax Deadline 2025 California Extended Benefits Remy Meagan, Our due dates apply to both calendar and fiscal tax years.

Irs California Tax Deadline Extended 2025 Drona Ainslee, You must send payment for taxes in california for the fiscal year 2025 by march 15, 2025.

Tax Deadline 2025 California Extended Eunice Catlaina, An extension to file your tax return is not an extension to pay.

Tax Day 2025 Date For California Nola Michele, There is a difference between how california treats businesses vs federal.

Federal Tax Filing Deadline 2025 For California Residents Ginni Justine, You can extend the due date for filing your personal income tax return by six months (e.g., to october 15, 2025, for 2025 tax year returns) by filing form 4868 or.